As a board member, keeping a close eye on your association’s financial health is one of (if not the) most important responsibilities of your position. This responsibility includes looking ahead at the association’s projected financial situation to assess stability and room for growth. Budgeting and forecasting are tools that can help you achieve this. But, what do they actually do? And, how do you develop and keep track of them?

Impact AMC Financial Specialist, Ingrid Beamsley, recently attended an educational session focused on budgeting and forecasting for financial and fundraising success. Below are a handful of her key takeaways from the event that cover budgeting and forecasting basics.

What is an Association Budget?

Associations create budgets to outline the fiscal year’s goals. It identifies the association’s future expenses and the revenue it aims to achieve. It is a detailed report used as a coordination tool.

In a budget, organizations:

Determine goals

Determine how expenses will be funded

Identify funding opportunities to close any gaps

Identify areas of spending that may not be necessary (discretionary vs non-discretionary items)

Do not change a budget to match actual funding

What is a Forecast?

In addition to creating a budget, associations should maintain a forecast. The forecast uses current data to make predictions regarding the future state of the organization over a specific period and assess the visibility of meeting the budget target. The forecast is unbiased and reviews expected outcome vs. targets.

In a forecast, associations:

Determine what is actually happening

Determine what we think will happen

Analyze and compare to the budget

Make corrective decisions as needed

Use a forecasting cycle – usually one or up to two quarters at a time

Focus on continuous goals and assess spending as needed

How Do I Maintain My Forecast?

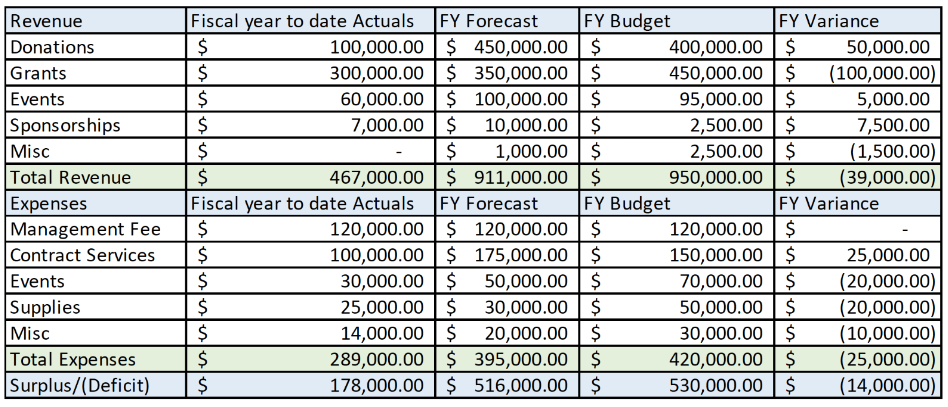

Budgets are inputted into the organization’s QuickBooks Online Accounts. Forecast is available with a QuickBooks Online Advanced subscription. However, it is possible to download the budget vs. actuals report into a spreadsheet and add a column on the spreadsheet for forecast (see Chart 1 below). This would allow more of an opportunity to adjust and determine final numbers.

Example:

Chart 1: Forecast vs Budget (Quarterly Review)

Chart 1: Forecast vs Budget (Quarterly Review)

Even though expenses in Chart 1 are forecasted to be less for the fiscal year, the forecast is also showing less grants. Thus, a deficit of $14,000. This means the organization needs to readjust another $14,000 in expenses for the fiscal year.

Get Help from Financial Experts

Budgeting and forecasting can help you and the rest of the board make data-driven decisions that ensure the financial health of your association over time. However, if your association does not yet have a well established budget or forecast, it can be tricky to get started.

Impact AMC Financial Specialists have many years of experience helping associations establish these processes and achieve financial stability and growth. Submit an RFP to discover how we can enable financial success for your association.